Auto Accidents

Auto AccidentsIt’s no secret your car loses value the longer you drive it. Unfortunately, after a car accident, your vehicle will be worth even less than usual.

If your vehicle sustained damages after a collision, you may be able to file an Alabama diminished value claim to recover compensation.

Please don’t hesitate to give us a call if suffered a bodily injury from your diminished value claim. You can reach us at (205) 407-6009 or send us a message for help.

What Is a Diminished Value Claim in Alabama?

A diminished value claim allows you to collect damages for your vehicle if it was damaged and its value has decreased.

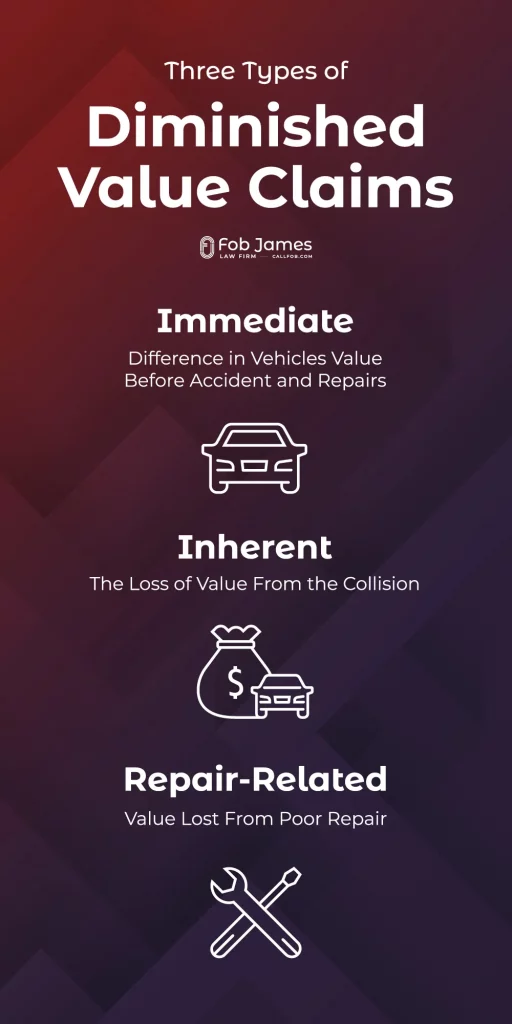

There are three types of diminished value:

- Immediate: the difference in your vehicle’s value before the accident and after the repairs;

- Inherent: the most common type, pertaining to the loss of value simply due to the collision; and

- Repair-related: the value lost from poor repair work following a car accident.

When it comes time to trade-in or sell your vehicle, it is likely to be challenging. Nowadays, it’s impossible to hide a car’s previous history. Your auto accident will undoubtedly be revealed, along with the repairs, and the vehicle will be worth much less.

Even if the car is perfectly repaired and looks new, the fact that it was involved in a collision remains.

What is Alabama’s Diminished Value Law?

Diminished value in Alabama is not codified in a statute. Rather, it is recognized by common law, which is Judge made law.

In Joiner v. Holland & Woodard Co., the Court recognized dminished value and explained that it is the difference between the value of the property before and after the damage.

Likewise, the Court in Alabama Pool & Constr. Co. v. Rickard held that the diminished value measure of damages is the difference in the property’s market value before and after the alleged damage.

How to File a Diminished Value Claim in Alabama

Alabama law allows drivers to file diminished value claims. You may file a diminished value claim in Alabama unless:

- You were at fault for the accident;

- The damage was due to something other than the auto collision; or

- You are an uninsured motorist.

Diminished Value Claims Against the At-Fault Driver

Diminished value claims are brought against the at-fault driver or their insurance company. The statute of limitations for diminished value claims in Alabama is typically two years from the date of the accident.

However, if the at-fault driver’s conduct was intentional, the statute of limitations for property damage claims is arguably six years from the date of the crash.

An attorney can help you file your diminished value claim. They will contact the at-fault party and their insurance company, as well as calculate your vehicle’s value. Your attorney may consult with outside parties to accurately calculate the diminished value.

After the at-fault party’s insurance company reviews your diminished value claim in Alabama, they will either deny the claim or offer a low settlement.

In either situation, your Alabama car accident attorney can communicate back and forth with the insurance company to reach a favorable outcome.

How to Prove Diminished Value

Proving the diminished value of your vehicle can be challenging.

You can consult various resources to try to come up with a calculation, but every situation is different. We can also work on getting a copy of the accident report for you.

Many factors go into proving diminished value, including:

- The accident itself;

- The damage your vehicle sustained;

- How old the car is;

- The make and model; and

- The current market.

It is best to consult with a lawyer to help prove the diminished value of your vehicle if you suffered an injury from the accident.

Contact an Alabama Car Accident Attorney

Navigating a diminished value claim on your own can be quite the task.

There is plenty that goes into these claims, but an Alabama car accident lawyer will know best how to handle it.

They can help calculate the value of your diminished value claim and communicate with the insurance company to help reach just compensation.

The Fob James Law Firm has over 40 years of experience helping clients after auto collisions.

We have the knowledge and expertise to help you attain a favorable outcome.

Contact us online or call our firm at (205) 407-6009 today, and let’s discuss your case.