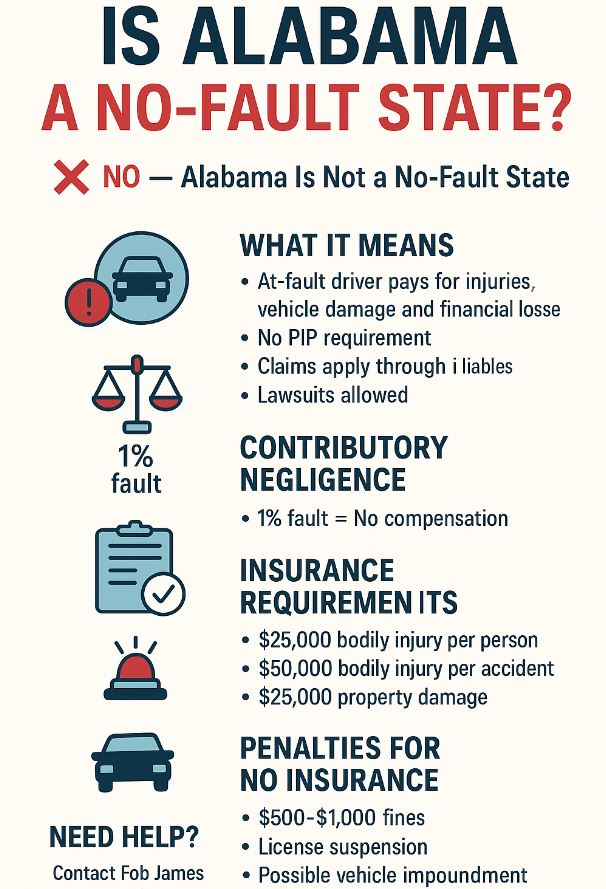

No — Alabama is not a no-fault state. Alabama follows a fault-based auto insurance system, which means the driver who causes the crash is legally responsible for paying for injuries and property damage. This differs from “no-fault” states, where drivers use their own PIP insurance first regardless of fault.

In this article, our Birmingham car accident attorneys explain how Alabama’s fault system works. We also discuss how contributory negligence affects your claim and what steps to take after an accident.

What Is a No-Fault System?

In no-fault states:

- Injured drivers file claims with their own PIP insurance

- They don’t need to prove the other driver caused the crash

- Lawsuits are restricted unless injuries are severe

Alabama does not use this system. Instead, it follows a traditional fault system and has one of the strictest negligence rules in the country.

Alabama Is a Fault-Based State

Under Alabama’s fault insurance structure the at-fault driver must pay for injuries, vehicle damage, and other losses.

Victims can pursue compensation through:

- A claim with the at-fault driver’s insurance

- A claim through their own insurer (if using MedPay or UM/UIM)

- A personal injury lawsuit

Because Alabama is fault-based, it is critical to prove liability after a crash. Evidence like photos, witness statements, police reports, and medical records becomes extremely important.

What Is Contributory Negligence: Alabama’s Strict Rule?

Alabama follows pure contributory negligence, one of the strictest laws in the U.S.

If you are even 1% at fault, you may be barred from recovering compensation.

This doctrine is confirmed under Alabama case law (Golden v. McCurry, 1979).

Insurance companies often use this rule to deny claims, including situations where:

- The victim was slightly speeding

- A driver briefly took their eyes off the road

- A vehicle had dim brake lights

- A driver made a defensive maneuver

Contributory negligence is why most victims need an attorney early in the process.

What Are Alabama’s Minimum Auto Insurance Requirements?

Alabama requires all drivers to carry minimum liability coverage:

- $25,000 bodily injury liability per person

- $50,000 bodily injury liability per accident

- $25,000 property damage liability

While this is only the minimum insurance required, you should consider higher limits to protect yourself further. Recommended optional coverages:

- Uninsured / Underinsured Motorist (UM/UIM)

- Medical Payments (MedPay)

- Collision & comprehensive

UM/UIM insurance helps an injured driver get compensation after an accident if the at-fault driver doesn’t have enough, or any, insurance.

UM/UIM is particularly important because Alabama has a high rate of uninsured drivers. We recommend that you buy as much UM/UIM coverage as you can afford.

$150,000 Settlement After Adjuster Said Our Client was At-fault

THE CASE: Fob James Law Firm helped a client in Mobile, AL, who worsened a pre-existing injury in a car accident. The client’s insurance company did not provide a fair offer. They claimed our client was partially at fault for speeding. We filed a lawsuit and with the black-box and gps data proved our client was not at-fault.

CASE RESULT: Fob James Law Firm took the case to trial and won a verdict against the insurance company for $150,000.00.

What Happens If You Drive Without Insurance in Alabama?

Driving without liability coverage in Alabama can lead to:

- $500 fine (1st offense)

- $1,000 fine (repeate offense)

- Driver’s license suspension up to 6 months

- Possible vehicle impoundment

- Personal financial liability for any damages you cause

If you are hit by an uninsured driver, you may need to file a UM/UIM claim. You can also submit the ALEA uninsured motorist claim form (SR-31).

What to Do After an Alabama Car Accident

In a fault-based contributory negligence state, protecting your claim is critical.

Do this immediately:

- Call 911

- Request a police report

- Get witness info

- Take photos + video

- Seek immediate attention

- Avoid giving recorded statements to insurers

- Contact a car accident attorney before speaking to insurers

What Is the Statute of Limitations in Alabama?

Alabama law sets deadlines for filing claims. For most car accident injury cases, Alabama allows:

- 2 years to file a personal injury lawsuit

- 2 years to file a wrongful death claim

- 6 years for property damage claims

Missing the deadline means losing your right to compensation.

How a Lawyer Helps Under Alabama’s Tough Negligence Laws

Because Alabama’s 1% fault rule is so strict, insurance companies often try to blame victims. An attorney can:

- Collect important evidence to show the other driver was completely at fault (including black-box data, camera footage, phone records, and witness statements)

- Counter insurance attempts to assign blame

- Gather medical, accident reconstruction, and witness evidence

- Pursue UM/UIM and MedPay claims

- File a lawsuit if needed

Fob James Law Firm has extensive experience handling high-stakes contributory negligence disputes.

When to Call Fob James Law Firm

Call our Alabama car accident lawyers if:

- You were injured

- The insurer is blaming you

- The other driver was uninsured

- Medical bills are adding up

- Your claim was denied

We offer free consultations, and you pay nothing unless we win.

Our motorcycle, trucking, auto, and wrongful death injury attorneys have obtained multiple six and seven figure outcomes in cases where the insurance company argued our client was at-fault.